Governments are implementing stricter regulations in response to consumer demands for more transparency regarding the safety and sustainability of the food they consume. A flurry of recent regulation, including the U. S. Food Safety Modernization Act ( FSMA ) and the EU Deforestation Regulation ( EUDR), is pushing agri-food producers to implement more robust traceability systems.

To achieve this, they are turning to cutting-edge technologies. By tracking the journey of agri-food products across the supply chain, traceability technologies are improving visibility and accountability, ensuring that the food on our plates is safe, morally sourced, and environmentally sustainable.  ,

The Impact of Food Fraud and Waste ,

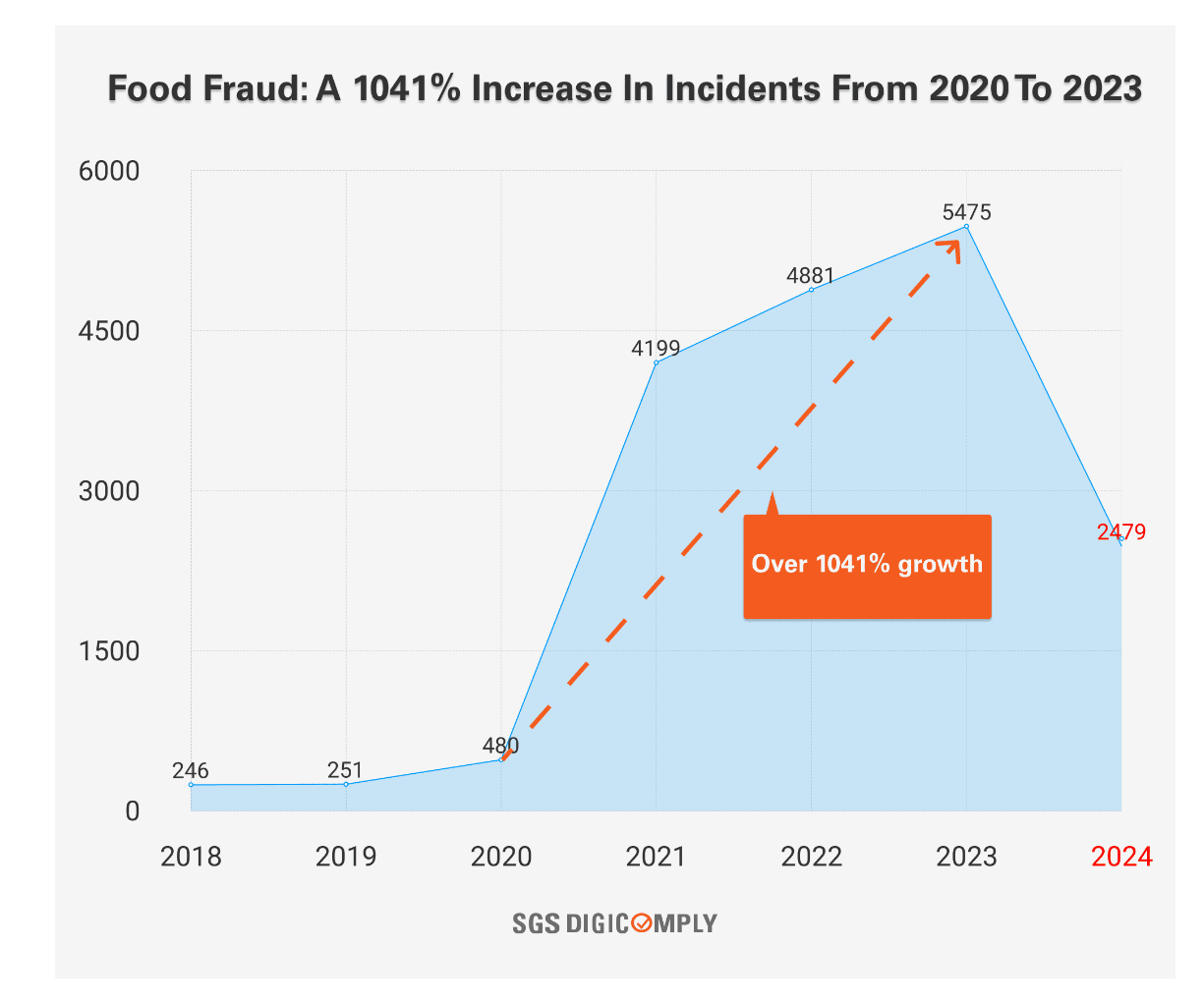

Food fraud has surged since 2020, driven mainly by supply chain disruptions related to the Covid-19 pandemic. As some supply chain actors try to meet demand and lower costs, deceptive practices like mislabeling have increased.  ,  ,

One example is the U. S. seafood market, where up to 40 % of shrimp is mislabeled. According to consumer concerns about quality, 30 % of fresh food is discarded each year due to concerns about this lack of transparency.

Food Fraud: A 1041 % Increase In Incidents From 2020 to 2023

According to the UN Food Waste Index, food waste accounts for roughly$ 1T annually for the global economy and accounts for 6-8 % of global greenhouse gas emissions. Increasing traceability could add$ 600B in profits to the world seafood industry by curbing illegal, undetected, and illegal fishing, and reducing food waste.  ,

Food Traceability Tech in Today’s Supply Chains

Food traceability involves capturing detailed data on the production, processing, handling, storage, and distribution of agri-food products. Companies can track food products’ movements throughout the supply chain by granting each food product or product special identifiers. This process enhances transparency, reduces waste, and combats food fraud.  ,

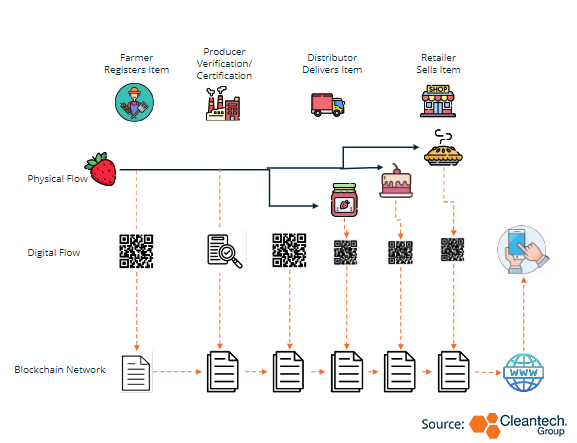

Tracing Food Provenance Using QR Codes &, DLT

Important information such as location, temperature, and handling practicesare typically stored in cloud-based traceability systems.  ,  ,

These systems, particularly for temperature-sensitive products like dairy and seafood, can reduce spoilage by up to 40 % and lead to more advantages like reduced emissions as a result of better logistics and resource management.  ,

Incumbents and Innovation ,

Technologies like blockchain, alongside cloud computing and IoT, are becoming more common. Incumbents like IBM, Walmart, and Nestlé dominate the market, but innovators offering professional, or niche services, can also carve out a place for themselves.  ,  ,

For instance, Darwin Evolution especially caters to Latin American exporters who are looking to find a foothold in particular regions.  ,

Existing technologies like blockchain have seen a lot of adoption, but there is still room for growth in emerging industries like biotags.  ,  ,

Biotags, which use chemical markers on food items, cater to niche markets like those for pure and non-GMO produce. Companies like Healthy Trace are using biotag technology to verify the authenticity of high-quality food products. In addition to the food industry, entrepreneurs like TraceChain and Oritain are even making a name for themselves by extending traceability solutions to industries like clothing and consumer electronics.  ,

Navigating the Path Forward

Start-ups must continue to excel in this market despite the importance of validation and pilot projects. Innovators who can demonstrate tangible return on investment ( ROI ) for agri-food producers and distributors, by improving operational efficiency, reducing waste, and enhancing safety, will be well-positioned to succeed.  ,

However, interoperability and standards compliance are key to scaling these innovations. Larger operators will favor solutions that can integrate with existing supply chain systems and adhere to international data standards, such as GS1 and the Global Dialogue on Seafood Traceability ( GDST ). For start-ups looking to scale, partnerships with important players in the food and agriculture sectors are also important, as evidenced by iFoodDS and IBM Food Trust collaborations.  ,

Keep a look out for… ,

- Growing demand for green protein sources: Rise of other proteins, including plant-based, cell-cultured meat, and insect-based products, is reshaping the food industry – as demand for these novel foods grows, traceability becomes important to ensure that they meet safety and ethical standards, particularly in supply chains where tale inputs are less familiar ,

- Sustainability-driven policies: Policies around carbon emissions, food waste reduction, and sustainable agriculture are increasingly tied to traceability requirements – as more of these come into play worldwide, innovators have an advantage in scaling, e. g., the EUDR is likely to drive scaling of traceability tech in the Latin American market due to co-dependance as trading partners for key agri-food products from the Amazon region ,

- Food safety scandals: As businesses look to reduce risks and protect brand reputation, high-profile incidents involving food safety have been quick to adopt traceability technologies, and we can anticipate a rise in the need for flexible solutions.