$ 2.3T needed from now to 2050 — delayed deployment could cost double, even triple

Point Source Capture ( PSC ) techniques are used to capture industrial sources ‘ point of emission. These hard-to-abate sectors include healthy gas, orange hydrogen, power generation, refineries, cement, iron and steel, chemicals, steam methane reforming, fermentation, and syngas producers. In 2022, these emitters produced 36 GtCO2 or 68 % of total emissions.

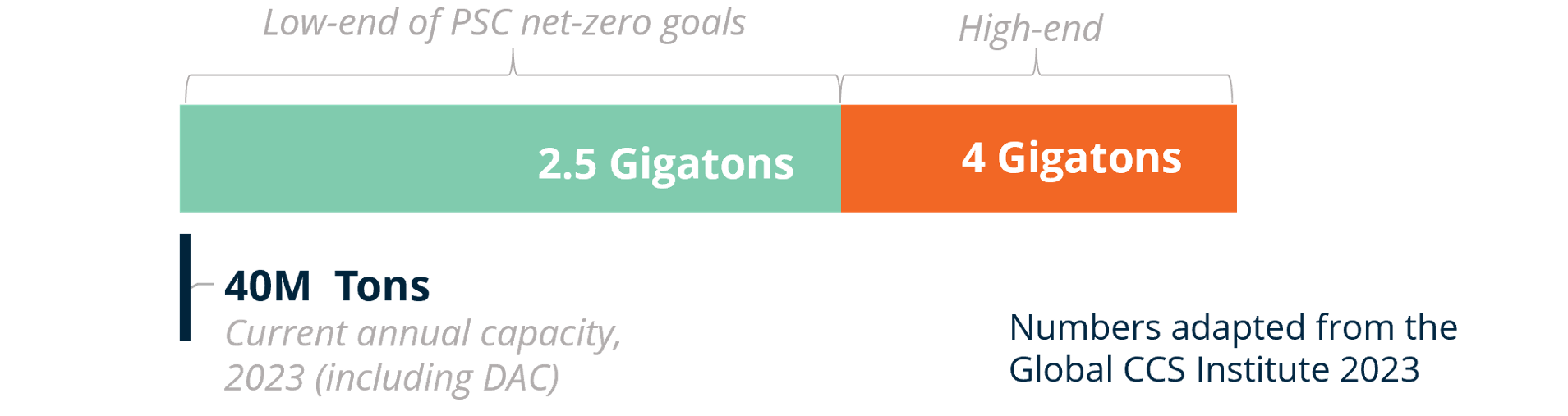

Through 2050, PSC annual investments totaling approximately$ 2.3T are required to achieve the net-zero goals set forth in the Paris Agreement ( Energy Transition Commission ). Good estimates suggest that PSC can deliver a crucial 2.5-4 GtCO2/year, under half of the 7-10 GtCO2/year needed to meet 2050 goals. The majority of the emissions will be largely captured by Direct Air Capture ( DAC ) capture. The 2024 annual capacity is around 50 MtCO2/year, away from 40 MtCO2/year in 2023. Capacity will need to increase by 50 to 90 times per year.

The Latest Annual Capture Capacity Trailing Behind PSC Net-Zero Goals, Massive Scale-Up Ahead

Sequestration in geologic formations, rocks, or construction aggregates ( the latter having a 60+ year lifespan ) can be used to achieve sector decarbonization, which involves permanently removing CO2 from the atmosphere. PSC can also improve overall carbon efficiency via short-term storage, however, this will not result in online carbon removal. This occurs when CO2 is used in fuels and chemicals, such as plastics and sustainable aviation fuel, to cause CO2 to be reintroduced into the atmosphere or environment.

A Suite of Technologies

Various technologies have been developed for PSC that include capture via solvents, good adsorbents, membranes, and frozen systems. Most begin to see cost-effectiveness at scales above 0.3-0.6 MtCO2/year.

The most advanced technology is available, and solvents have the best chance of capturing the majority of the market. Non-amine solvents claim a 20-30 % reduction in OPEX and CAPEX. Solid Adsorbents are a high surface-area solid material, e. g., Metal Organic Frameworks ( MOFs ) with a selective affinity for CO2 in a gas stream. Membranes are typically cost-effective at smaller scales and can be combined with MOFS, solvents, and more because they have a great affinity for CO2. As a result, freezing systems are developing as a method for storing CO2 as a liquid, which uses roughly the same amount of energy as the gas being processed. Additional processing may be performed before CO2 is utilized, transported, or stored.

Innovator Callout

- Carbon Clean developed solvents that can 50 % lower the cost of CO2 capture from major polluters. Its technology can also be applied to existing gas treatment plants in the natural gas industry to lower operating costs by 30 %.

- Svante, a multi-year winner of the Global Cleantech 100, uses MOFs via its VeloxoTherm ™ process with rapid cycle-temperature swing adsorption.

- With high flux rates and low pressure, Ardent (fka Compact Membrane Systems ) selectively captures greenhouse gases.

Business Models and Market Dynamics

Government support, like as the creation of a carbon pricing system, is required because there is no standardization and regulation around pricing. For example, the U. S. and Europe are leading project development and have committed over$ 20B in capital grants and loans, however establishing carbon contracts-for-difference and procurement programs for high-value products like fuels.

The U.S. Environmental Protection Agency announced a ruling just last week that natural gas power plants must reduce or capture 90 % of greenhouse gas emissions by 2032. This rule creates a historical precedent that will result in power generation players having to evolve carbon markets that are cost-effective, or they could cut off the power supply or raise costs for their customers in order to comply with new plant regulations.

And the private sector is adopting a number of business models and carbon pricing strategies. For instance, there are projects in development that are n’t tied to a particular sector. Carbon capture hubs have become the normative mode of deployment, with utilization, transportation, and storage facilities being built in tandem with utilization, which can even help lower the end costs. However, CO2 utilization will generally be driven by the costs of its end products, e. g., CO2 is utilized to produce urea at industrial scale at$ 300-$ 450/tCO2.

Without economic incentives or policy drivers, industry is n’t jumping to adopt urgently. Yet more dissuading uptake is that the sectors requiring PSC most frequently lay at the higher end of the cost curve, i. e., cement, power, steel. Without PSC, we will rely entirely on DAC, which could double or even triple the capital investment needed for PSC infrastructure, making PSC one of the least expensive abatement options. In the case of cement, it’s the only option.

However, perceived project risks, investor distrust, high project costs, and over-anticipated CO2 demand have led to project pauses and delays, e. g., Shell and Equinor have both abandoned blue hydrogen projects. Additionally, there is public pressure on the UK government to halt a$ 1.3 billion investment in blue hydrogen as a result of scientists ‘ doubts about its viability.

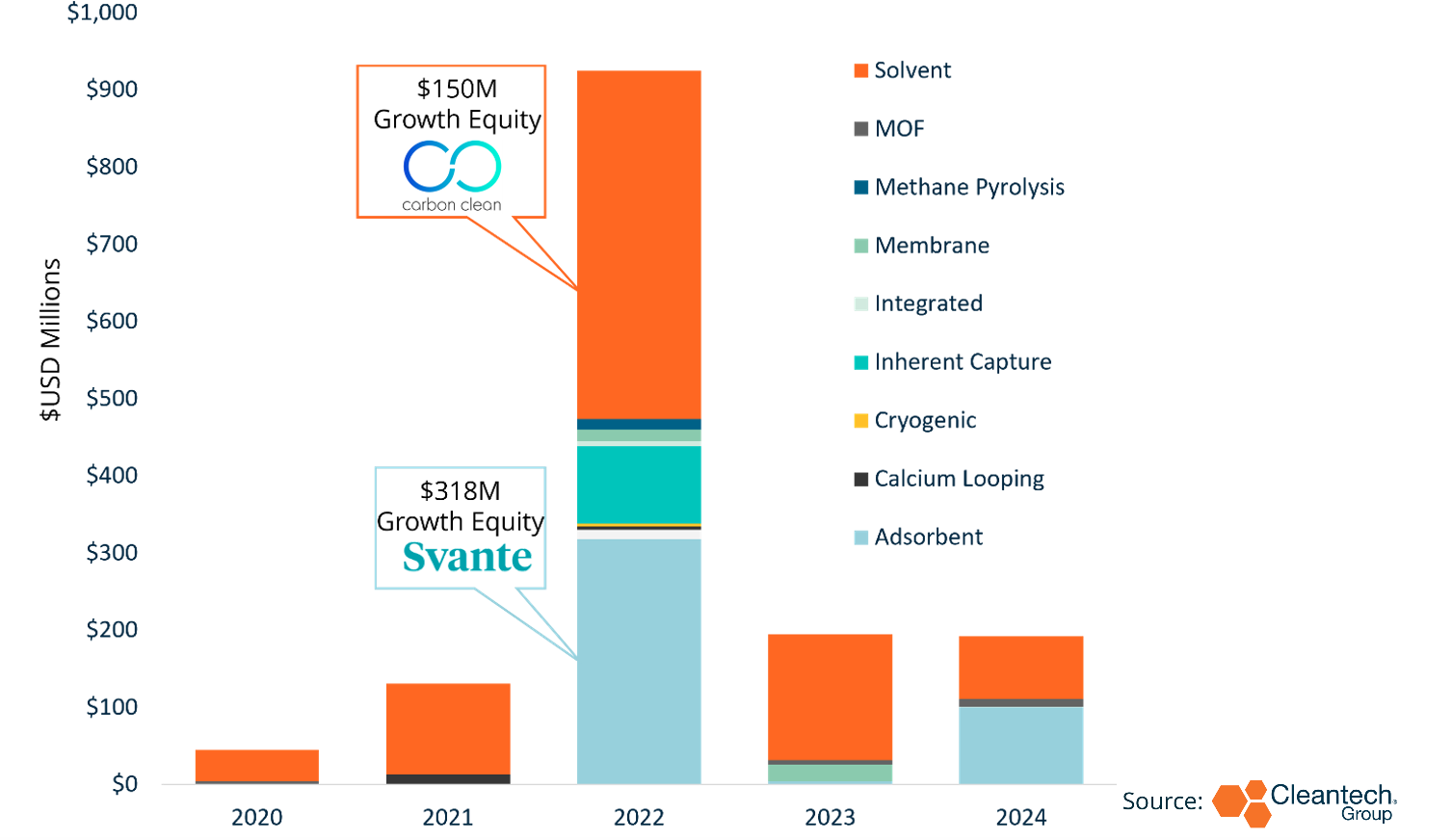

2022 Venture Activity Soared, General Upward Trend

Since 2020, 111 deals have raised more than$ 1.7 billion in venture capital funding. In 2022, a record high was recorded for volunteer activity, with over$ 925.4 million raised in 15 deals, of which four Growth Equity rounds accounted for more than half of the entire funds. This includes Svante’s huge$ 318M funding round from Chevron Technology Ventures and Temasek, among 12 others, Entropy’s$ 300M Growth Equity from Brookfield Renewable Energy Partners, and Carbon Clean’s$ 150M Growth Equity from CEMEX Ventures, Samsung Ventures, Chevron Technology Ventures, among others.

While 2022 is an outlier, the entire activity is trending upward. In 2023,$ 209M was raised across 10 deals including C-Capture that raised$ 12.4M from bp Ventures, Kiko Ventures, among others, for its pilot facility. Enthusiastic raised$ 16.5M from Chevron Technology Ventures, Solvay Ventures, Technip Energies and others. Over$ 233 million was raised as of October 2024, including a$ 30 million Series A for Mantel to create a demonstration project for its molten-salt capture solution, in addition to an additional$ 100 million for Svante.