A news originally on ITProToday 1 . Our version

John Portal – Take Tree Team

The end of an Era

I recall the precise moment in 2007 when I realized the financial sector was about to face a reckoning. I didn’t receive any information that would have given me a heads-up about the housing industry. A man who worked in banking was the subject of the conversation. Despite having studied English in school, he didn’t seem particularly experienced or interested in the financial markets and had no real interest in his career. However, he was extremely wealthy and the first to inform me of” the number.”

To avoid having to work again, you must make this number before turning 40. He was close to this person, who was around my time. The analyst in me, who finds markets interesting but was a struggling graduate student at the time, interpreted this as an indication that something is wrong if an industry pays higher wages to people who aren’t very good at what they do. It is a balloon, one made of human money.

A question of IT governance

When I read this private account of a technologies entrepreneur concerned that he might not reach his number next week, it brought to mind this conversation. The group that was after huge, quick money has moved on to the tech sector. However, the gold rush is almost over.

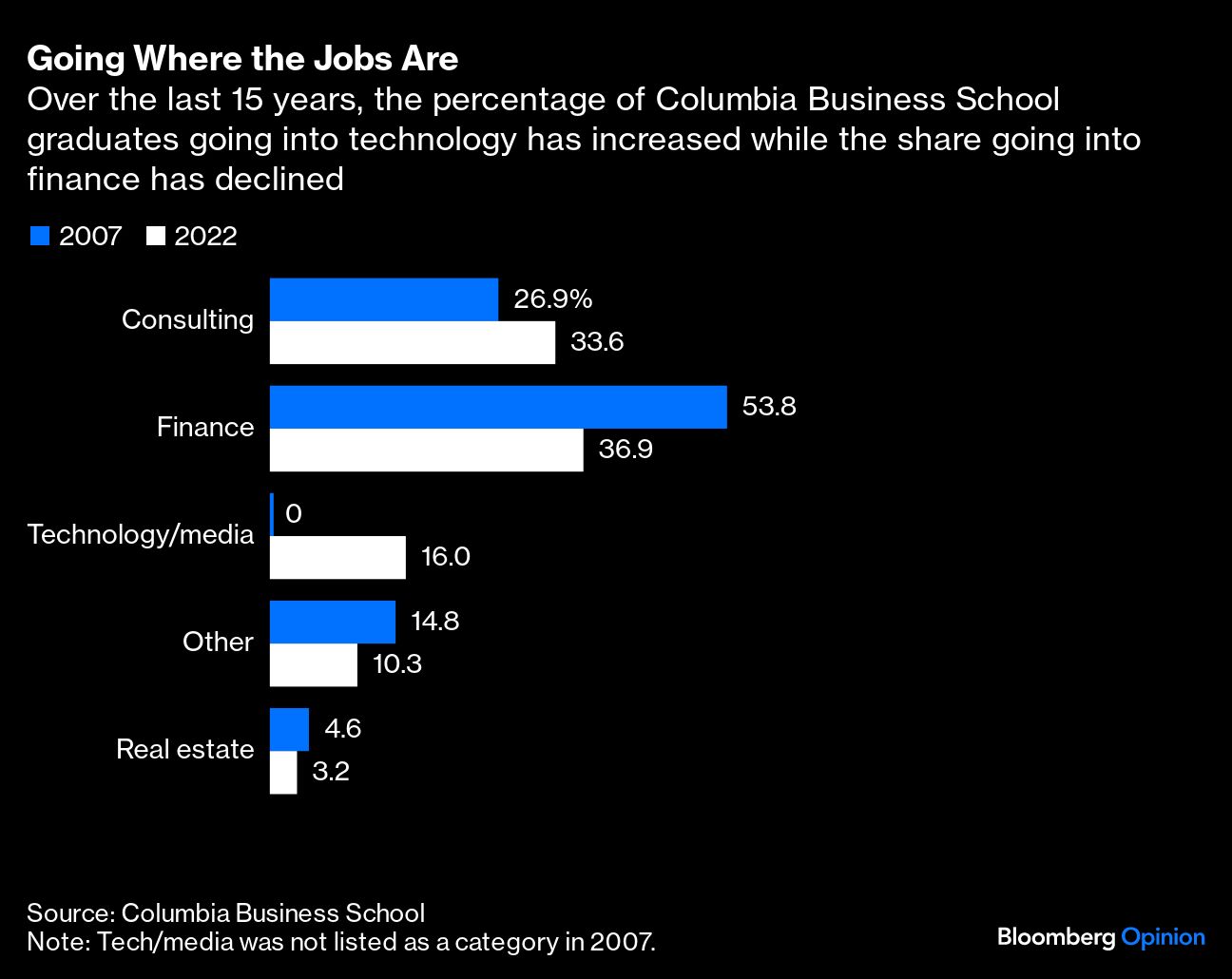

Take a look at what has transpired over the past 16 years in the economic sector. People with an interest in financing are typically drawn to Columbia Business School, which is located in Manhattan. More than half of its graduates entered the financial services sector in 2007, and its annual job report did not also include technology as a category. Five years later,” tech / media” was drawing 8.3 % of its graduates, and by 2022, the percentage had increased to 16 %. Just about one-third of the money was spent on fund in the interim.

Where are student going?

Among students at prestigious institutions, the trend is even more pronounced. In 2007, 47 % of Harvard undergraduates majored in finance; in 2021, only 21 % did, and 17 % in technology. Wealthy schools are, by definition, only attended by a small portion of the population, but they are the ones with the most career opportunities, making them instructive.

To be honest, it appears that students can use their talents productively in the technology sector. It is rife with cutting-edge businesses that make the world a better position, and some graduates did unavoidably launch their own companies and find employment. However, an industry can only lavishly encourage a certain number of people.

For instance, that private tech entrepreneur founded a profitable business, but he is still seeking his big break and is probably not going to be able to retire youthful. He is very late, which is part of his trouble. Tech’s outsize returns depended on emerging businesses receiving significant venture capital and finally going public or, more probable, being bought by a bigger business. However, the number of offers and Investments has drastically decreased, and this trend is likely to continue. Funding is more difficult to come by due to higher interest rates, and large corporations have less money to purchase companies.

The digital sector will likely contract as well. It will continue to play a significant role in the economy, but with fewer employees and higher earnings.

The next question is where younger people looking for wealth will look. It is human nature to seek fortune wherever you can, from the Age of Discovery to the real California Gold Rush to Snapchat. It plays a significant role in advancing an business.

The banking industry and the software industry, however, are unusual in that they attracted many people who expected to become wealthy even if they lacked two things typically associated with extreme money development: adding a lot of value to the market and taking wise risks.

The historically low interest rates of the last few years, which contributed to making money extremely affordable, are merely to blame for anyone’s belief that things should be unique. It makes sense that quick fortunes may be made risk-free if the cost of capital is essentially zero.

Of course, that was never the case. Chance persists perhaps in a world with nearly zero interest rates. Simply put, and occasionally against their will, it is transferred to others. A significant portion of the venture capital funds used to finance technology came from public-sector pension money. As a result, retired teachers and firefighters( or taxpayers on the hook for underfunded pensions ) were bearing the risk, just as the financial froth in the 2000s ultimately cost low-income homeowners.

May higher rates make it more difficult for the upcoming technology to invest in the next new thing as they enter the labor market? No always, but the movement might be less frequent. My meetings with the most unscrupulous people I know lead me to believe that green technology will be the next big thing. Government funds offers capital without much risk, even if interest rates continue to be large( at least to those in the industry ).

The growth of natural technology will ultimately benefit the economy, just like it did in finance and technology. However, there will be a lot of skills and financial waste in the process. The new business will draw its share of annoying people in it just to reach their number, just like finance and tech did before it. This is the cost of advancement.