Sheep agriculture is essential to human wellbeing and survival,nbsp. About 26 % of humanity’s protein needs are met by the farming of livestock, which includes land-based animal husbandry, ranching, grazing, and aquaculture. However, according to The World Bank, it also accounts for 10 % to 20 % of global greenhouse gas emissions. In addition,  ,

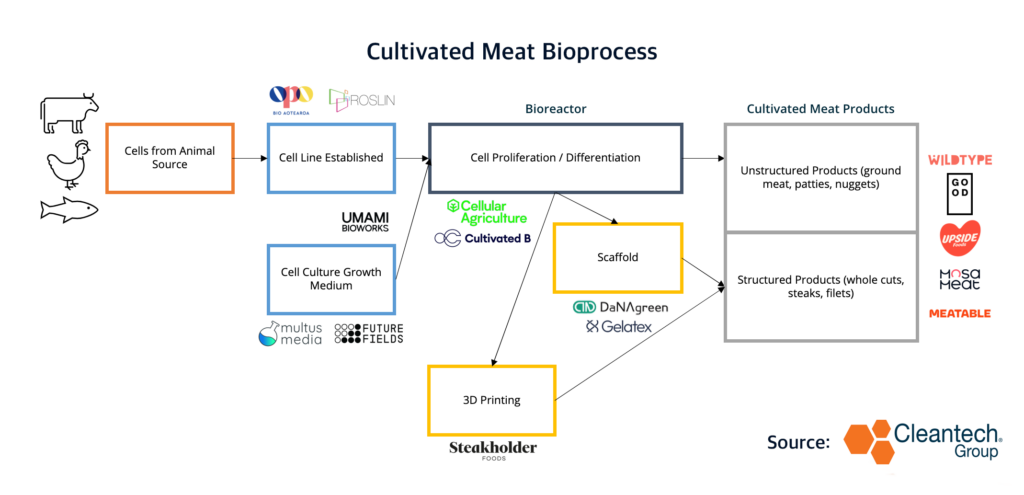

By growing edible tissues from isolated animal cells in a bioreactor environment,” planted meat,” also referred to as “cell-cultured protein” or, more commonly, as lab-grown meat, enables the production of pet proteins without the need to raise, farm, or slaughter animals.  ,

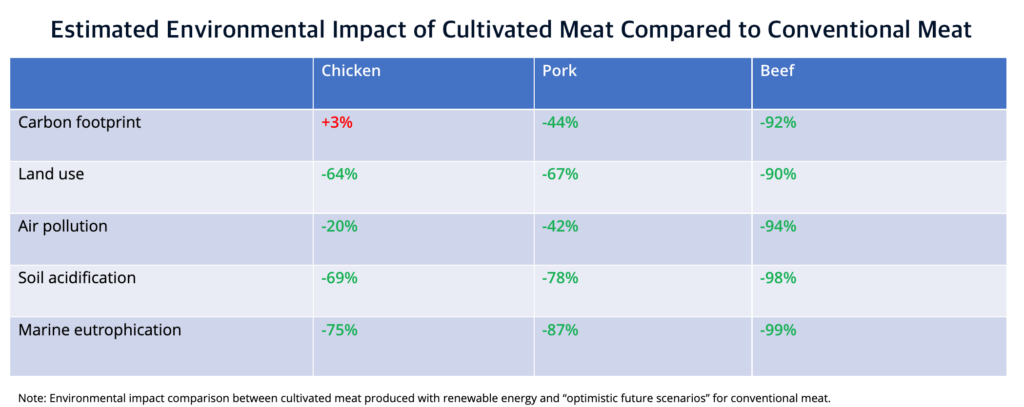

According to one review of life cycle assessments, raising animal protein in this manner as opposed to through livestock production would reduce the emissions profile of meat by up to 92 %. Additionally, it would significantly lessen various harmful environmental effects like air pollution and degraded soil and water.  ,

However, the cost of producing cultivated meat continues to be extremely high, and the technology is still generally restricted to research facilities and a small number of pilot plants, far from the commercial-scale manufacturing needed to take the place of even the smallest portion of the livestock industry.  ,

Additionally, new food regulations generally apply to cultivated meat technologies and products, and they must be approved before being sold or served to consumers. Only two countries—Singapore and the United States—have so far approved planted meat products for public consumption. These approvals cover items from the Upside Foods and Eat Only companies, but they are not generally sold in either country because it would be economically unwise to produce them on such a large scale.  ,

Based on recent expectations, perhaps the most positive projections for cultivated meat end-products place a 9–10x premium on prices for conventional animal-derived equivalents.  ,

The following are major cost drivers for the production of farmed meat and seafood:  ,

- Growth media: The nutrient-rich input that promotes the growth and proliferation of disconnected cells. Growth factors and hybrid proteins are among the most expensive media components. Pet serum, which is made from the blood of killed animals, has traditionally been used in this context because it has all the necessary nutrients. However, it is incredibly cheap and goes against the final goal of choice protein, which is to replace at least a portion of the animal agriculture industry, because it was produced in the slaughterhouse industry.  ,

- Bioreactors/cultivators: These create the conditions for cell proliferation and differentiation into muscle, fat, and other types of cells.  ,

- nbsp, water management and wastewater treatment

Given the aforementioned, reducing production costs is the primary focus of much of the innovator and investment activity in this area. Various strategies include:  ,

- Technologies like plant molecular farming, precision fermentation, or insect farming ( e .g., Tiamat Sciences, Bright Biotech, Future Fields, Integriculture ) produce more affordable and environmentally friendly components for growth media.  ,

- Utilizing AI/ML to enhance media formulations and production processes for sustainability and affordability ( e .g., Multus Media ).  ,

- designing infrastructure, processes, and cultivators that are less expensive ( for example, Cellular Agriculture, The Cultivated B).  ,

- Cheaper and more environmentally friendly scaffold materials from algae and plant sources enable greater end-product differentiation in terms of texture and appearance ( e .g., Gelatex ).  ,

- Alternative texturization methods include 3D bioprinting ( for instance, Steakholder Foods ).  ,

Upstream Focus  Shifting,

Venture funding used to typically go to planted meat innovators who positioned themselves as horizontally integrated businesses managing production and consumer-facing brand marketing.  ,

However, due to financial and legal restrictions, more innovators are emerging who play a B2B role by offering ingredients, consumables, or production technologies to newcomers and established businesses that are committed to producing end-products.  ,

This has also signaled a greater fusion of plant-based and fermentation-derived products, as well as other fields within the larger other protein sector. In many instances, these various scientific pathways offer cost, production, or quality advantages over one another in particular contexts, such as the use of cultivated fat cells in a plant-based end-product to improve consumer experience or the production of growth factors through precise fermentation.  ,

Commercial Engagement ,

It is noteworthy that, despite the fact that the planted meat industry is still in its pre-commercial stage, some of the largest meat and dairy companies in the world have engaged in venture investment, M&, A, or creative activity to gain a foothold in it.  ,

- The largest meat processor in the world, JBS, has set a net-zero target for 2040 and aims for ‘no-deforestation’ supply chains by 2025. For an estimated$ 59 million, it purchased Spanish-made cultivated meat innovator BioTech Foods last year. It also spent$ 41 million to open a R&, D center for raised meat in Brazil.  ,

- The second-largest processor and marketer of beef, chicken, and pork in the world, Tyson Foods, has made investments in a number of cultivated meat start-up businesses, including <a href="https://i3connect.com/company/future-meat-technologies”>Believer Meats and <a href="https://i3connect.com/company/omeat”>Omeat, as well as bottom foods.  ,

- In contrast to its usual activity in the plant-based and fermentation environments, Nestle joined forces with Israel’s Believer Meats in July 2021 to “examine the potential of farmed meat components.”

Looking ahead and nbsp,

We anticipate that the trend of more funding being directed toward B2B models and technologies that aim to address the production bottlenecks in farmed meat will continue. Investors are adopting a longer-term strategy, moving their focus away from consumer brands and goods deeper inland and toward back-basic technologies that may contribute to the realization of planted meat end-products.  ,

Great meat and dairy corporations are likely to keep expanding their presence in the cultivated meat market as more advancements in production costs are made and more regulatory approvals are given globally.  ,